-

Juicers

-

Multifruit solutions

-

Industrial

-

Accessories and spare parts

-

Services

-

Expand your knowledge

-

View all machines

-

Buy accessories

-

Search for spare parts

-

Discover which Zumex juicer suits you needs

-

Self-cleaning

-

Zitrux

-

Zitrux Compact

-

Juicers

-

Soul Series 2

-

Minex

-

Essential Pro

-

Versatile Range

-

Speed Range

-

Speed Pomegranates

Professional juicer machine

Professional juicer machine

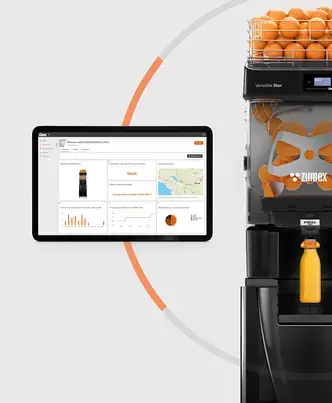

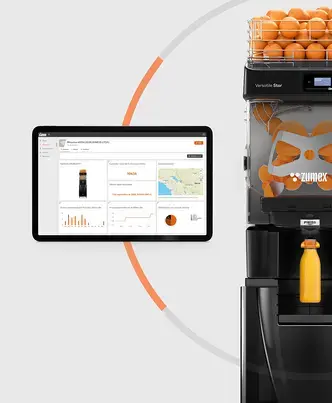

Zumex Connect

Expand your knowledge

Canal Food Retail

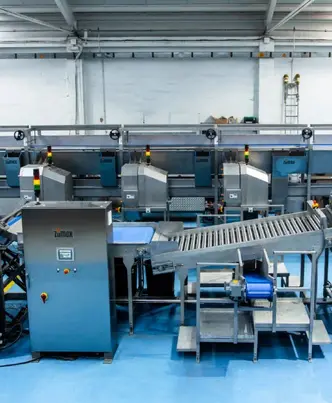

Canal Industrial

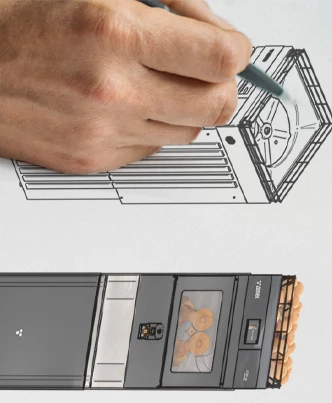

Our philosophy and values